Cash Out

The most loved way

to get paid as you work

to get paid as you work

-

Transfer up to $150/day, up to $750/pay period, to a linked bank1

-

No interest, no credit check, no mandatory fees2

-

Over 19 million downloads — and counting

Early Pay

Get your paycheck up to

2 days early in your bank

2 days early in your bank

-

Get your pay up to 2 days earlier (or sooner)3

-

No need to switch your bank

-

Your money, your speed

Balance Shield

The stress-free way to

protect your bank balance

protect your bank balance

-

Help avoid overdraft fees and low balances

-

Stay in the loop with real-time notifications

-

Turn on optional auto-transfers of $1005

Credit Monitoring

Get moving on your

credit goals

credit goals

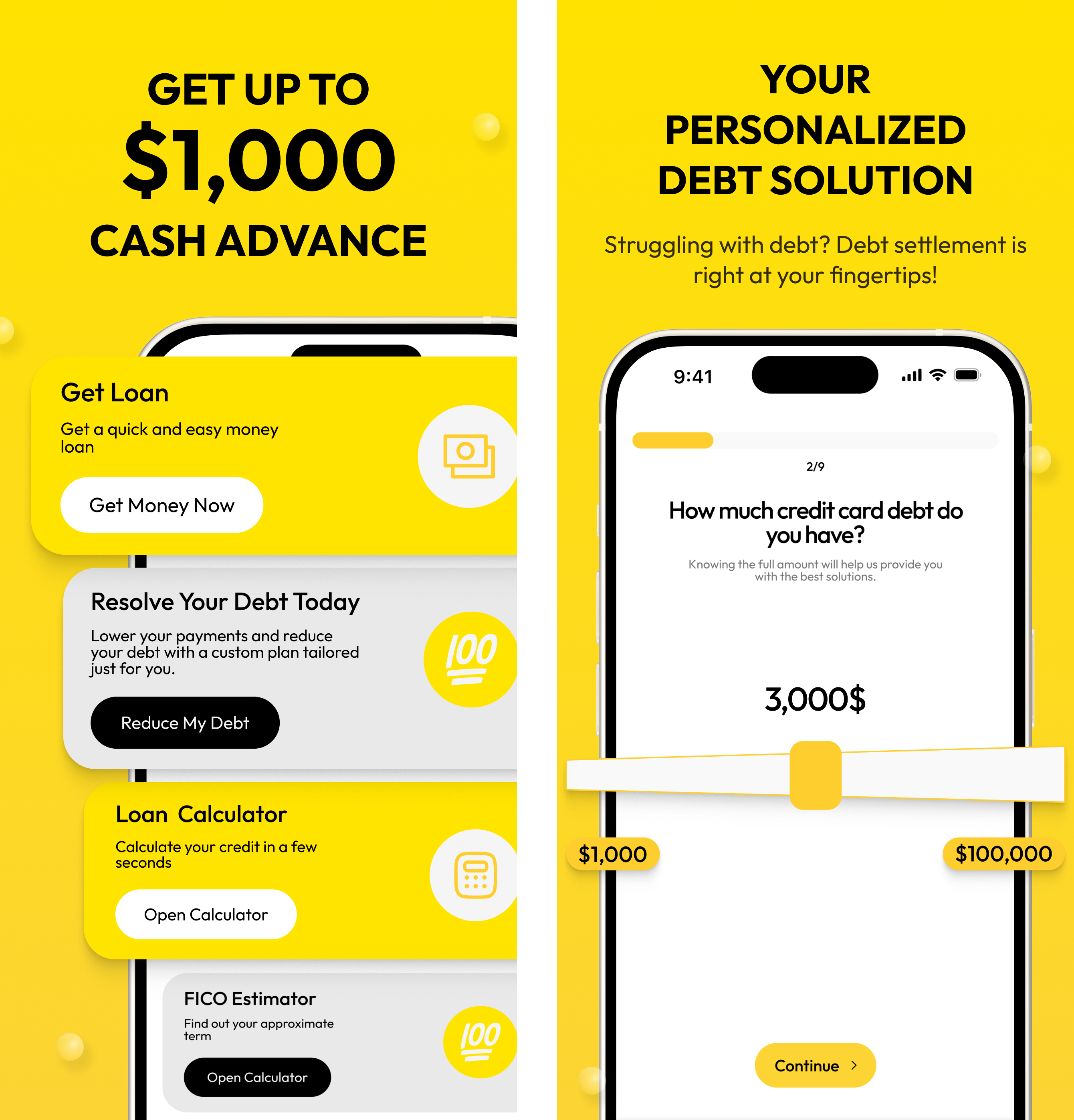

Guide Money Borrowing LLC

Online loans

designed for you

-

Same-day funding available

-

Personal service

-

No hidden fees